Tulsa, Ok Bankruptcy Attorney: Understanding Bankruptcy And Alimony Payments

Table of ContentsTulsa Bankruptcy Lawyer: Strategies For Reducing Credit Card Debt Post-bankruptcyBankruptcy Attorney Tulsa: How They Help You Get Back On TrackThe Value Of A Tulsa Bankruptcy Lawyer In Achieving A Fresh StartBankruptcy Attorney Tulsa: A Guide To Chapter 7 And Chapter 13

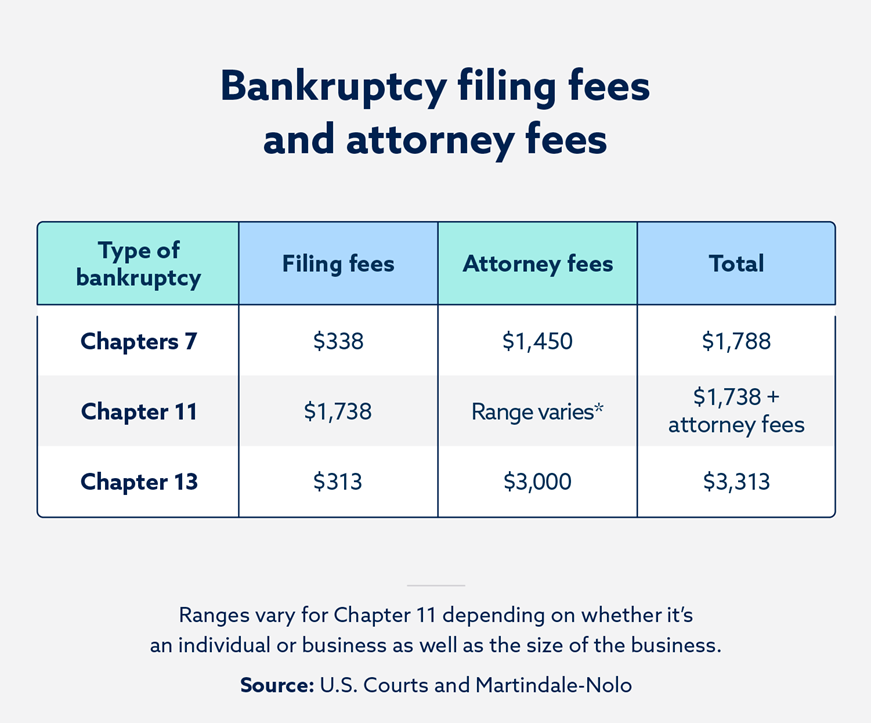

It can harm your debt for anywhere from 7-10 years and also be a challenge toward getting security clearances. If you can not fix your issues in much less than five years, bankruptcy is a practical alternative. Lawyer costs for bankruptcy vary relying on which form you select, exactly how intricate your instance is as well as where you are geographically. bankruptcy attorney Tulsa.Other insolvency costs include a declaring charge ($338 for Phase 7; $313 for Phase 13); as well as costs for credit report therapy as well as economic monitoring courses, which both cost from $10 to $100.

You don't constantly require an attorney when submitting private bankruptcy on your own or "pro se," the term for representing on your own. If the situation is simple enough, you can file for bankruptcy without help.

The general regulation is the less complex your personal bankruptcy, the much better your chances are of completing it by yourself and also receiving a bankruptcy discharge, the order getting rid of debt. Your instance is likely basic enough to manage without an attorney if: Nonetheless, also simple Chapter 7 cases need work. Intend on filling in extensive documentation, gathering monetary documents, investigating insolvency as well as exception laws, and also complying with neighborhood regulations and treatments.

The Role Of A Bankruptcy Lawyer Tulsa: What To Expect

Here are 2 situations that always call for depiction., you'll likely desire a legal representative.

If you make a blunder, the personal bankruptcy court can throw out your instance or offer properties you thought you could keep. If you lose, you'll be stuck paying the debt after personal bankruptcy.

If you make a blunder, the personal bankruptcy court can throw out your instance or offer properties you thought you could keep. If you lose, you'll be stuck paying the debt after personal bankruptcy. You could desire to file Phase 13 to catch up on home mortgage defaults so you can keep your house. Or you may intend to do away with your 2nd home mortgage, "stuff down" or decrease a vehicle loan, or repay a financial debt that won't go away in personal bankruptcy in time, such as back tax obligations or support arrears.

You could desire to file Phase 13 to catch up on home mortgage defaults so you can keep your house. Or you may intend to do away with your 2nd home mortgage, "stuff down" or decrease a vehicle loan, or repay a financial debt that won't go away in personal bankruptcy in time, such as back tax obligations or support arrears.In many instances, a bankruptcy lawyer can swiftly identify concerns you could not detect. Some individuals documents for insolvency due to the fact that they don't comprehend their choices.

Tulsa, Ok Bankruptcy Attorney: Your Key To A Successful Case

For many consumers, the sensible choices are Chapter 7 and Chapter 13 insolvency. Tulsa OK bankruptcy attorney. Phase 7 can be the method to go if you have low revenue and no assets.

Staying clear of paperwork mistakes can be troublesome also if you select the proper chapter. Below prevail concerns bankruptcy attorneys can protect against. Bankruptcy is form-driven. You'll need to finish a lengthy federal package, and also, in some situations, your court will additionally have local forms. Many self-represented insolvency borrowers do not file every one of the called for bankruptcy papers, and also their instance obtains rejected.

If you stand to shed valuable property like your residence, auto, or various other home you care around, an attorney could be well worth the money.

Most Chapter 7 situations move along naturally. You declare personal bankruptcy, go to the 341 conference of lenders, and obtain your discharge. Yet, not all bankruptcy situations proceed smoothly, as well as other, extra difficult issues can arise. Numerous self-represented filers: do not recognize the importance of activities and adversary actions can not properly defend against an activity seeking to deny discharge, and also have a difficult time conforming with complex personal bankruptcy procedures.

Tulsa, Ok Bankruptcy Attorney: Debunking Common Bankruptcy Misconceptions

Or something else might surface. The lower line is that an attorney is crucial when you find navigate to this web-site on your own on the receiving end of a motion or legal action. If you decide to declare insolvency on your own, learn what services are readily available in your area for pro se filers.

, from sales brochures explaining inexpensive or cost-free solutions to detailed info concerning personal bankruptcy. Look for a personal bankruptcy publication that highlights circumstances needing an attorney.

You have to accurately complete several kinds, research the legislation, and attend hearings. If you understand bankruptcy law but would certainly like assistance finishing the types (the average bankruptcy request is around 50 web pages long), you might take into consideration employing a bankruptcy application preparer. An insolvency application preparer is anyone or service, aside from an attorney or a person who helps a legal representative, that charges a cost to prepare insolvency papers.

Because personal bankruptcy application preparers are not lawyers, they can content not provide lawful recommendations or represent you in personal bankruptcy court. Particularly, they can not: inform you which kind of insolvency to file inform you not to list certain debts inform you not to provide specific properties, or tell you what home to excluded.

Because personal bankruptcy application preparers are not lawyers, they can content not provide lawful recommendations or represent you in personal bankruptcy court. Particularly, they can not: inform you which kind of insolvency to file inform you not to list certain debts inform you not to provide specific properties, or tell you what home to excluded.